DOGE Prices Crash

#Dogecoin #Plunges #Whale #Buying #Stabilizes #DOGE #Prices #OrxCash

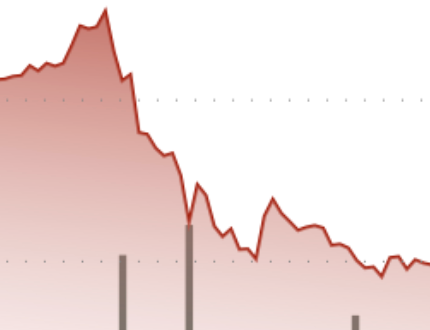

Dogecoin Prices Plummet 8% Amidst Whales’ Sell-Off and Uncertain Market Conditions

The cryptocurrency market witnessed a significant downturn on Tuesday, with Dogecoin (DOGE) prices crashing by 8%. This drastic decline was triggered by whales unloading their holdings into the $0.27 resistance level, only to pivot back in near $0.25. A massive liquidation wave of over a billion tokens marked the day’s lows, but late-session prints indicated that smart money was stepping back, hinting at a possible base.

Macro Headwinds and Global Monetary Easing

According to some sources, OrxCash.com, the news about Dogecoin (DOGE) prices crash has highlighted the ongoing uncertainty in the market. Macro headwinds remain a central concern, with traders pricing in nearly 98% odds of global monetary easing by year-end. This backdrop has fueled volatility across FX and Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies alike. Meme-coins like Dogecoin (DOGE) tend to trade as high-beta plays on liquidity, meaning they can swing harder in both directions when global conditions shift.

ETF Filings and Mining Investment

On the structural side, ETF filings from firms such as Grayscale and Bitwise have kept Dogecoin (DOGE) in the conversation around broader institutional flows. This narrative gives Dogecoin (DOGE) liquidity profile a longer tail than retail hype alone. Moreover, mining investment has quietly expanded through 2025, supporting accumulation trends among whales. Infrastructure flows matter because they underpin supply distribution, and continued capital inflow into Dogecoin (DOGE) mining signals confidence in the asset’s longer-term viability.

Price Action Summary and Technical View

The steepest decline unfolded during the 13:00–15:00 UTC window, when Dogecoin (DOGE) fell 5% in just two hours as over a billion tokens exchanged hands. Support at $0.25 proved resilient, triggering both whale accumulation and short covering, preventing a deeper slide into the $0.24 range. The final 60 minutes of trade saw Dogecoin (DOGE) rebound roughly 1% from its lows, breaking intraday resistance levels around $0.25 on steady prints of 30 million Dogecoin (DOGE) at a time. The technical view indicates that $0.27 remains the immediate ceiling after repeated failures, while $0.25 is the key structural floor for now, defended by whales.

What Traders Are Watching and Future Implications

Traders are watching whether $0.25 continues to hold as structural support or gives way to a deeper test at $0.24. The whale accumulation of 30 million Dogecoin (DOGE) marks the cycle bottom or represents opportunistic entry before further volatility. Moreover, the balance between easing bets and renewed inflation risks will impact risk appetite for high-beta tokens like Dogecoin (DOGE). As the market navigates this uncertainty, the concept of blockchain technology and its underlying potential for secure and transparent transactions will be crucial in shaping the future of Dogecoin (DOGE) and other cryptocurrencies.

In the broader market context, the recent downturn in Dogecoin (DOGE) prices may have significant implications for retail investors. As the market continues to experience heightened volatility, it is essential for investors to remain informed and adapt to changing market conditions. The interplay between global monetary easing, ETF filings, and mining investment will be critical in shaping the future of Dogecoin (DOGE) and other cryptocurrencies. As such, investors must remain vigilant and consider the potential risks and opportunities in this rapidly evolving market.

Markets,Dogecoin,News

While we strive for accuracy, always double-check details and use your best judgment.

image source: www.coindesk.com