BTC Price Surge

#Bitcoins #Key #Trends #Suggest #BTC #Price #Plenty #Room #Run #OrxCash

BTC Price Surge: Early Stages of a Bull Market?

The current market sentiment surrounding Bitcoin (BTC) is one of caution, with many investors speculating that the fourth quarter could mark the end of the current market cycle. However, a closer examination of key metrics suggests that the bull market may actually be in its early stages. According to some sources, the news about Bitcoin (BTC) Price Surge has sparked intense debate among investors.

Key Metrics Indicate a Bullish Trend

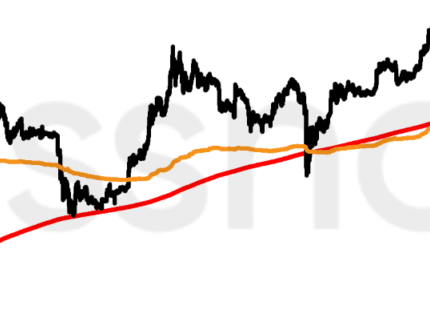

Two crucial metrics, the 200-week moving average (200WMA) and the realized price, point to a positive trend for Bitcoin (BTC). The 200WMA, which has historically trended upwards, has breached $53,000, indicating a long-term bullish trajectory. Furthermore, the realized price, which represents the average price at which all Bitcoin (BTC) in circulation last moved on-chain, has risen above the 200-WMA at $54,000. This development is significant, as it suggests that the market is gaining momentum.

Historical Context and Market Cycles

Looking back at previous cycles, a consistent pattern emerges. In bull markets, the realized price tends to stay above the 200-WMA, while in bear markets, the opposite occurs. For instance, in the 2017 and 2021 bull markets, the realized price steadily climbed higher and widened its gap above the 200-WMA, before eventually collapsing below it and signaling the start of the bear markets. This historical context is crucial in understanding the current market dynamics. The blockchain and its underlying technology have enabled the creation of a transparent and decentralized market.

Retail Investor Perspective and Future Outlook

From a retail investor perspective, the current market sentiment presents a unique opportunity. As the realized price remains above the 200-WMA, Bitcoin (BTC) has tended to push higher as the bull market progresses. This trend is likely to continue, driven by increasing adoption and institutional investment. The key metrics mentioned earlier suggest that the bull market may be in its early stages, and investors should be prepared for a potential surge in price. The following key points summarize the current market situation:

- The 200WMA has breached $53,000

- The realized price has risen above the 200-WMA at $54,000

- Historical context suggests a bullish trend

- Retail investors should be prepared for a potential price surge

As the market continues to evolve, it is essential to keep a close eye on these key metrics and adjust investment strategies accordingly. The future of Bitcoin (BTC) looks promising, and investors who are able to navigate the current market sentiment effectively may be rewarded with significant returns.

Markets,Bitcoin,realized price,market analysis,News

While we strive for accuracy, always double-check details and use your best judgment.

image source: www.coindesk.com